.

I

Tuesday 1st. December, 2009

https://www.dgmlive.com/diaries/Robert%20Fripp/2009-12-01-rf-diary

One of lessons clearly available from the internet is that we are to be held accountable for our public postings, whether sweet or sour; and those are not the only two available options. When I comment on Mr. Alder & Endless Grief it is with the hands-on experience of 21 years of being managed by Mr. Alder and his partners; an extensive archive of documents from over that period (with before and after); legal investigation of his financial affairs in critical periods; depositions by witnesses for the proposed action; and more. Why mention this? Because I am accountable, including to UK libel laws. That is, my comments have material to support and substantiate them.

Those who find themselves straying onto the path of public commentary on Endless Grief, unknowing of the remarkable damage and repercussions this had on the lives of quite a few employees and artists, would do better to have some sense of the enormity involved, and the disruption to more lives than my own.

One example of commentary without knowledge, a classic of its kind and referred to on several occasions before: in the 1990s the writer Michael Bloom declared the reason for the Endless Grief dispute was that the EG managers did not go on the road with KC. Mr. Bloom declared that the proper place for management was in the office doing deals (he did not mention that Mark Fenwick did accompany ELP and Bryan Ferry with Roxy Music for much of their touring). Well, Mr. Alder was in the office doing deals: that was, arguably, part of the problem. What Mr. Bloom failed to comment upon in his rendering, as a significant factor in the dispute, was Mr. Alder’s diversion of c. £2 million of artist income via Athol & Co. to support the collapsing affairs of Messrs. Alder & Fenwick. Perhaps this was of greater relevance than how much time the partners spent on the road with the band? Mr. Bloom’s clueless and uniformed comment shows how reasonably intelligent and basically decent people can easily comment on subjects upon which they are well out of their depth. The arrogance and sense of self-importance is easily forgivable, less so for those who declare their views publicly as “professional authorities”; but not easily excusable.

Why do I continue to comment on EG? There are several answers to this. Today I present one: Because I am just about the only person who can.

All right! Here’s a second: Because I hold Mr. Alder accountable for his actions.

A few of the many files, currently being scanned…

I

II…

The original Willowfay Agreement…

… by which EG has the right to acquire 30% of the KC publishing copyrights on 5th. January 1975 or within one year thereafter. Mr. Alder, with David Enthoven, visited me at Sherborne House on February 22nd. 1976, just outside the one-year window, for me to sign over my copyrights to EG. This constituted undue influence and was in any case subject to an oral collateral warranty (this doesn’t change anything!).

One of Mr. Alder’s handwritten letters, i.e. it was not subject to secretarial oversight within the EG office…

On the 7th. June 1990 Mr. Alder is now very worried about (RF’s) project and financial state – there is just not enough income to cover your borrowing… I don’t say that I am worried too often, so can we speak on this a.s.a.p.? Mr. Alder does not mention the two preceding accounting periods when EG did not pay my record royalties; but does mention increasing my increased-borrowing by £25,000 which he signed as (my) attorney. That is, he acted, formally on my behalf, to extend my borrowing to cover the non-payment of EG royalties, without actually mentioning the non-payment of royalties, while also now being very worried about my financial state - but not worried enough by my lack of income to pay those royalties.

Investigation (1992) of Ikenstock Ltd…

… There is no trace of this company in… England, Scotland, Northern Ireland and Wales. There are several possible explanations… the… more likely possibility is that Ikenstock is an off shore or foreign company.

My letter to Music Week of August 13th. 1993…

… with an explanation of rendered documents for Music Week to rebuff Mr. Alder’s threat of a libel action against the publication, following their front-page articles on EG.

There are others, besides Mr. Alder, whose actions have had serious and adverse consequences for me, personally and professionally; and two of these not far distant from Endless Grief. Both persons accepted that their conduct was less than ideal, with repercussions on others including myself, that were severe and long lasting. The first sent me a handwritten letter of apology; this was accepted and the matter closed. The second presented an apology in person; which was accepted and the matter closed. Today, both are personal friends. I have no problems with mistakes made, responsibility accepted, honestly and honourably addressed.

Those innocents visiting the Diary, who have no interest in the resonances and repercussions of Endless Grief, have my sympathy: it is not a subject that lifts my heart. Both EG partners are forgiven; that is not the issue here. In respect of those who have no interest in this sad and instructive affair, and the abuse of trust it demonstrates, please pass over and take no further interest. Those who do feel the need to publicly comment on my affairs, better to be well-informed. Those who wander out in public, with their heads placed where sunshine never falls yet feel the need to comment on the weather, sometimes good to carry a raincoat.

Finally, for this Diary entry, on the subject of business…

Mr. Alder to RF, in his office at 63a, Kings Road, Chelsea with Mark Fenwick, at our final personal meeting (but not final conversation) on April 17th. 1991: You’re a businessman – just like we are!

Firstly, I was a professional musician, not a businessman; although (to quote Keith Tippett) a professional musician must be businesslike. But when a professional musician becomes primarily a business person, the music dies in them.

Secondly, to the extent that I was a businessman, it was quite unlike Messrs. Alder & Fenwick.

II

Tuesday 10th. February, 2009

https://www.dgmlive.com/diaries/Robert%20Fripp/2009-02-10-rf-diary

An afternoon of sorting boxes for Hernan & Martin to collect next week. Most of today’s files are highly prejudicial and concern Endless Grief.

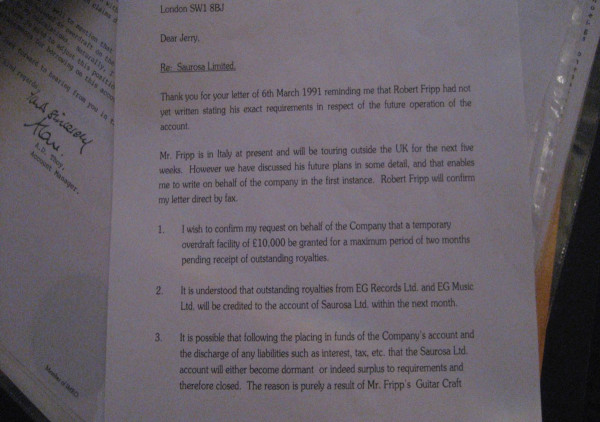

A letter of March 7th. 1991 from Mr. Alder to the manager of Coutts’ extending my overdraft I…

II…

… to cover the shortfall in my company affairs due to the non-payment of EG royalties, which Mr. Alder loaned back to Mr. Alder and his partner via another of their companies. May we note, I paid the interest on the Coutts’ overdraft and Mr. Alder paid no interest on the forced loan he raised against me, nominally acting on my behalf. Shortly afterwards, on tour in Europe with The LCG, I notified Coutts’ that Mr. Alder was no longer authorised to act on my behalf. Mr. Alder’s response: You made me look like a common criminal! Well.

And a letter of January 22nd. 1992 from the auditor who recently died, and whose ashes were fired off in a rocket last Fifth of November I…

The letter addresses my enquiry as to why, when the Polygram audit of 1982/1983 gave EG £300,000, did the artists receive so little? I received £3,599.68 & Bryan Ferry c. £6,500 (and Bryan was the largest EG artist, by a significant factor). The auditor writes that 70 artists received relatively small amounts, but provides no further explanation. He does not comment that, in addition to being my auditor, he was also EG’s auditor at the time of the audit, and was continuing as EG’s auditor at the time of writing this letter. Neither does he mention how much of the £300,000 stayed went to EG. Well.

Headlines in Music Week during 1993…

I

II…

III…

IV…

V…

VI…

VII…

VIII…

IX…

X…

The opinion of the EG Music Group’s Managing Director, expressed to me not long afterwards, was that EG never recovered from these headlines. More accurately, EG never recovered from selling the record and publishing catalogues in 1991; the headlines made public what was already the situation in the office.

In happier times, the Financial Times from August 1975…

… two years before Mr. Alder took over EG. David Enthoven is in the middle, Mr. Fenwick on the left of picture, and Mr. Alder on the right. This was a glory year for EG business, and about to get much glorier in 1976 and 1977. IMO, this clearly demonstrates that, in this generation of music-being-made-available, the initiative had moved from the musical imperative to industry interests.

III

Wednesday 11th. February, 2009

https://www.dgmlive.com/diaries/Robert%20Fripp/2009-02-11-rf-diary

More boxes of Endless Grief files, including this (IMO) Document Of Deceit…

This is the Assignment of Copyright for Schizoid Man to EG, dated 22nd. February 1976 (while I was at Sherborne House, Gloucestershire) – so EG could collect my royalties! And Mr. Alder, Good Guy That You Can Trust, Chartered Accountant, Treasurer of Nordoff-Robbins for several years, adviser to the Palace and many other good works, looked me in the eyes while telling me this.

What’s that at the bottom?...

Sam G. Alder signs on behalf of EG Music Ltd., the beneficiary of Mr. Alder’s advice as business manager to the Assignor; and the signatures of two witnesses who weren’t at the meeting they are witnessing.

IV

Sunday 7th. August, 2011

https://www.dgmlive.com/diaries/Robert%20Fripp/2011-08-07-rf-diary

It seems that the focus of my professional life has returned to Rough Music. The years of Endless Grief may have prepared me to some extent for OMG – it’s UMG! A 20-year nether-world tour from EG to UMG.

Rough Music (With The Left Foot).

The ritual use of cacophonous sound in the punishment of moral offenders… designed simultaneously to expose, rebuke and humiliate those who had seriously offended…

Christopher Marsh: Music And Society In Early Modern England. (Cambridge 2010).

I

I have been looking at the EG digital archive, and it continues to amaze me. In both EG and UMG cases, there were/are several areas of concern. But, in very simple terms, in only one of the examples of clear infraction, both EG and UMG failed to account.

There are, it seems, so many ways to prevaricate, obfuscate, delay, provide irrelevant details to distract focus from core issue/s and evade this one central point – non-accounting – that I wonder whether the Main Men responsible for determining the company cultures received Jesuitical training during the first seven years of their drawing-breath. In EG’s case, non-accounting to me took the form of four consecutive royalty periods during 1989-91. In UMG’s case, no statements have been presented over a period of 19 years Summers & Fripp CD releasing.

The reasonable person might ask: why not own up to mistakes, errors and omissions, and rectify them? then continue: Responsibility is one of the four pillars of the ethical company. One quick answer in response: Owning up to mistakes, errors and omissions acknowledges liability to the offended parties. So, if the companies are concerned not to meet their liabilities, for whatever reasons, the primary course of action is to deny their mistakes, errors and omissions as far as they possibly may without being caught-out by demonstrable untruths/lies; and the secondary course, to prevaricate and obfuscate in the instances where malfeasance is clear and inescapable.

In SG Alder Esq.’s case, owning up would have opened up a range of accompanying issues, including breach of trust and duty of care, conflict of interest, and violation of professional standards of conduct as a chartered accountant. All these carried negative effects upon the Main Men’s hopes of a successful return to the music industry, with new licensing deals to Virgin and BMG Publishing in place (1991); and perhaps more important in the long term, to Mr. Alder’s reputation as Good Guy and Uprising Worker of Good Works.

In UMG’s case, owning up would attract attention to the fragility and unreliability of their management and control systems in two areas:

1. Their takeover of other companies (we have had problems with the UMG takeovers of Island, Sony-BMG, Sanctuary and A&M).

2. The Music Industry’s Bright New Future of digital downloads, the only area Mr. UMG UK Power Possesor No. 2 addressed resolutely. Resolutely, that is, after 18 months of blocking by Mr. Second Tier Lawyer (who also gave me grief when he was at Virgin).

Where to begin, to present a consistent account of Endless Grief, from the mass of material? Let’s hear it for digitalization and easy reproducibility! Perhaps a core document, even the primary document in this archive, is a letter from Mr. Andrew Stanger, the Director of Business Affairs at EG, who wrote on EG headed notepaper from the EG Music Group Office at Blenheim House, 180, Kings Road to Coles Miller Solicitors in Wimborne, on 5 March 1991.

Coles Miller represented Michael Giles, founder member of KC and drummer in KC69. Michael was wondering why EG had not been paying his royalties on In The Court Of The Crimson King. Michael was not managed by Messrs. Alder and Fenwick, so had outside counsel and advice, unlike myself. Coles Miller, acting on Michael’s instructions, addressed this reasonable question – where’s my money? – to the Managing Director of EG, who passed it to Mr. Stanger. An artist is perhaps easily ignored, but a solicitor less so.

Mr. Stanger (in an online testimonial by Mayer Brown): noted by clients for being highly focused and amenable and who highlight his impressive turnaround time even on issues that were technically challenging and applaud his willingness to pick up the phone and clarify any issue we want. Others note that a particular strength is his ability to explain things in eloquent and concise layman's language. Just the kinda Go-To Guy needed to sort out the problem of where’s my money? then!

Mr. Stanger’s reply…

Unfortunately we are not at present in a position to be able to pay publishing royalties to your client…

In my book, that explains things in eloquent and concise layman's language. On 21 March 1991 Mr. Stanger wrote to Coles Miller enclosing a cheque signed by Messrs. (Mark) Fenwick and Stanger, dated December 31st. 1990, for the royalty period ending 30 September 1990.

In reply, on 24 April 1991, Coles Miller demanded interest on the late payment and the future-establishment of a client account for Michael Giles. You have, in effect, confessed to using our client's money for your own purposes. Litigation is threatened unless a full response is not made by EG within seven days.

Mr. Stanger did not reply until 3 June. I’m not sure this quite counts as an impressive turnaround time even on issues that were technically challenging.

II…

Key points from Mr. Stanger’s reply:

1. The delay in royalty payments was due to an unexpected delay in the completion of the sale of E.G. Records Ltd. to Virgin (now Virgin EG Records Ltd).

2. I do not accept your claim for interest.

3. I am also not in a position to agree that royalty payments received will be credited to a designated account. As you can see there is no provision for such a course of action in the assignment agreements.

In point 1, critically, the formal EG position on the reason for non-payment of artist royalties now moved from the frank and straightforward admission of EG’s Director of Business Affairs that we are not at present in a position to be able to pay publishing royalties to your client…

to…

… an unexpected delay in the completion of the sale of E.G. Records Ltd. to Virgin.

Problematically, Mr. Stanger’s statement of 5 March 1991 acknowledged that EG were unable to pay: therefore, the liability for non-payment was directly EG’s. The subsequent EG position, articulated on 3 June 1991 - an unexpected delay in the completion of the sale of E.G. Records Ltd. to Virgin - is a frequently-recurring element in my own Endless Grief correspondence, and avoids EG being trapped in an untruth. The unexpected delay does not explicitly deny that EG were not… in a position to be able to pay publishing royalties but implies that the responsibility for non-payment was no longer EG’s: therefore, EG had no liability for late payment. We would have paid you if the sale to Virgin happened sooner!

As an explanation in/of royalty accounting, this is nonsensical.

EG received royalties from its licensees within the six-month period prior to paying royalties to its artists (there are fine details, but the overall picture is sound). In the industry, this is sometimes referred to as The Six-Month Problem. If licensors use/divert client income-received before the due accounting date, instead of putting it in protected client accounts, and are unable to re-fill The Pot before payments are due, then they may have to send out letters saying unfortunately we are not at present in a position to be able to pay publishing royalties to your client. Or, as in the case with some EG-managed artists, not even send out letters.

One might also ask: what relevance does the delayed sale of EG Records have on royalty payments by EG publishing? Clearly, Mr. Stanger’s letter of 3 June 1991 shows that income flows and licensing receipts to the two EG companies (EG Records and EG Music) were not kept distinct; and went into (what was known in the early 1970s as) The EG Pot.

Nor is there mention in the 3 June 1991 letter of the series of draw-downs from Virgin Records in anticipation of the completion of the sale of E.G. Records Ltd. to Virgin (now Virgin EG Records Ltd). My own conversations at the time, with MA Fenwick Esq. (SG Alder’s partner) and very highly-placed persons at Virgin, suggests that by the completion of the sale, a significant part of the sale price (c. £2.5 million) had already been paid over by Virgin. What had happened to that?

So, a fuller explanation by Mr. Stanger in his 5 March 1991 letter might have been:

1. We don’t have the money.

2. EG Music publishing income went the same way as EG Records’ income.

3. We have received a large proportion of the EG Records sale from Virgin.

4. You’re not having any of it.

5. It’s not our fault.

Nevertheless, the unexpected delay serves to give a spurious justification to avoid acknowledging what had taken place at EG (cf Coles Miller): using clients’ money for its own purposes.

So, what happened to the money that came into EG and didn’t go out to artists in prompt payment of their royalties?

Most likely the key time-period, perhaps the beginning of The Drive To Endless Grief, is August 1988. This coincides with two UK events with particular impact on the partners:

1. The unstoppable inflationary surge in the British property market suddenly stopped, as if overnight.

2. The first warnings of major problems for Lloyds’ Names.

A third factor, the slowing of the music industry, was an additional problem, but not itself catastrophic to the interests of the EG Main Men, Messrs. Alder and Fenwick.

Cash-flow problems at EG in 1989 became in 1990-91 a crisis.

1990

1. The EG Music Group's loss for the financial year 1990 was £942,000 on a turnover of £3,735,000.

The EG Music Group was owed in excess of £4,000,000 by a company under the common control of Messrs. Alder and Fenwick, presumed to be Old Chelsea, the partners’ property development arm. Auditors Hughes Allen reported they were unable to form an opinion as to the recoverability of this debt (Old Chelsea went into liquidation in August 1992, settling the question of recoverability).

2. In The Athol Trust, the pension scheme for the benefit of the EG Music Group's controlling directors, the Chairman of the Trust's remuneration was £30,000 (the same as 1989); the highest paid director received £93,500 (£85,000 in 1989). No premiums were paid in 1990 (cf the trustees were paid £100,000 in 1989).

The EG Music Group’s outlay of funds to The Athol Trust in 1990 was £123,500 (i.e. 13.11% of its financial loss for the year).

3. The EG Music Group Ltd. paid £292,000 (£269,000 in 1989) for the consultancy services of Athol & Co. Ltd. (Messrs. Alder and Mr. Fenwick each received £180,000 from Athol & Co. in the financial year 1989 but the accounts for 1990 were not filed as of March 1993).

4. EG Music Group loss £942,000

EG Music Group paid to Athol Trust £123,500

EG Music Group paid to Athol & Co. £292,000

EG Music Group payments to Athol & Co. + The Athol Trust

= £415,500

(1989 - £484,000)

i.e. payments to the two Athols = 44.06% of EG Music Group's financial loss for 1990.

5. By December 31st. EG Music Group was unable to meet its royalty payments to artists.

6. EG Management Ltd. (incorporated August 1988) had a profit for the year of £11,000 on a turnover of £185,000, and carried forwards an accumulated loss of £19,000.

7. Old Chelsea Property Corporation had a loss for 1990 of £2,320,432 on a turnover of £1,750,196 and carried forward an accumulated loss of £2,712,198 to 1991 (and went into liquidation on August 12th. 1992).

OCPC's tangible assets fell by over £1,000,000 in the year from just over £5,000,000 to approx. £4,000,000. The write-off was in respect of the value of investment properties which were valued by the Directors (i.e. Messrs. Alder and Fenwick) who concluded that the values ascribed to investment properties (mostly freehold) were reasonable.

Auditors Hughes Allen concluded (the company accounts are dated February 1992) that the going-concern basis of the Old Chelsea Property Corporation was only justified if its bankers and creditors continued to support it for the forseeable future. (It appears this ceased in August 1992 when, it is likely that of the creditors, Coutts & Co. pulled the plug).

Three reasonable questions:

1. Why were Messrs. Alder and Fenwick of the EG Music Group unable to pay both first- and second-period royalty statements on publishing and records in 1990, to artists managed by Messrs. Alder and Fenwick of EG Management; in the same year that Messrs. Alder and Fenwick of the EG Music Group were able to increase the pay of Messrs. Alder and Fenwick of Athol & Co. to £292,000 (from £269,000 in 1989) for continuing to consult to themselves at the EG Music Group?

2. How were Messrs. Alder and Fenwick of the EG Music Group able to pay Messrs. Alder and Fenwick of Athol & Co. £292,000 in 1990 for Messrs. Alder and Fenwick’s consulting services to the EG Music Group; given that these consulting services increased the financial loss of the EG Music Group for 1990 to £942,000?

3. Where did the lotsa-money payments to Messrs. Alder and Fenwick, from whichever of the companies under their common control, actually go? That is, if not (at least partly) in royalty payments to EG artists?

V

Tuesday 16th. August, 2011

https://www.dgmlive.com/diaries/Robert%20Fripp/2011-08-16-rf-diary

In the filing cabinet, folders of terror and wonderment…

… all part of the voluminous EG Archive. Researches on Mr. SG Alder’s offshore company, Ikenstock, at the time of Endless Grief…

… and astonishingly: An Examination Of Royalty Accounting Records of EG Music Ltd. On Behalf Of Bryan Ferry And Companies 1/10/88 Through 30/9/90…

This is a highly confidential document, and very informative. It would perhaps have surprised Mr. Alder that this was in my hands, as Bryan and his advisers are subject to a gagging order and unable to discuss any of the details regarding royalty payments during the Unfortunately We Are Not At Present In A Position To Be Able To Pay Royalties To Your Client Period (1989-91). This is only one of the highly prejudicial EG-related documents that arrived, in an unmarked brown envelope, during the early 1990s.

From happier times…

… SG Alder Esq. writes: Looking forward to another interesting year together. Perhaps neither of us anticipated how many interesting years lay ahead.

VI

Thursday 15th. April, 2004

https://www.dgmlive.com/diaries/Robert%20Fripp/2004-04-15-rf-diary

And in the recent news …

Mr. Alder, the "honest, God-fearing family man" (his own words), a member of the Institute of Chartered Accountants (although he failed his finals), a freemason, adviser to the Prince’s Trust, a member of the Silver Clef committee fundraising for Nordoff-Robbins Music Therapy (of which Mr. Alder was Treasurer for several years), the “Good Guy That You Can Trust” (his words), the (former) artist manager “renowned for his Probity and Sound Business Practices” (the words of his solicitor), who “has Nothing To Hide – what has he done?” (his own words), a “Big Boy Caught With His Pants Down” (his own words again), a Backroom Boy at EG in 1970 who aspired to the Front Office (which, given the catastrophic collapse of EG, was arguably beyond his grasp) rarely draws much public attention to his business activities. A rare delight, then, for those who follow Mr. Alder’s interests with an interest of their own… [Expired weblinks from Isle Of Man sources, newsing Athol Radio Ltd. Below.]

Not long ago, Mr. Alder presented himself (to a former EG employee) in these words: I’m a gentleman farmer now! I am unable to comment on the veracity of the claim, although Mr. Alder may be a farmer. However, according to these online news reports, Mr. Alder’s status has changed: media entrepreneur Sam Alder. Mr. Alder is part owner of a radio station…

AIMING TO BE RADIO TWO

02 April 2004

THE MEN behind the latest company to be granted a radio licence say they hope their station will be on air by the end of the year and will cater for a BBC Radio Two-type market.

Athol Radio Ltd has been working on the application for 18 months and received news of the success from the Communications Commi-ssion on Monday.

Behind the station is Ron Berry, former Manx Radio presenter and director of advertising firm The Agency, former Manx Radio presenter and sales and marketing manager George Ferguson, and businessman Sam Alder.

The address, given in the reports, of Athol Radio Ltd. is the same address as accountants Messrs. Alder Dodsworth & Co. - 22, Athol Street, Douglas, Isle of Man, UK, IM1 1JA…

http://www.find-uk-accountant.co.uk/isle-of-man/douglas/alder-dodsworth-and-co.html

What’s in a name? Athol & Co. was the company lent some £4 million by the EG Music Group in the period 1988-91. Both Athol & Co. and the EG Music Group were under the common control of the two partners in EG, Messrs. Alder & Fenwick.

Athol & Co., its finances supported by the loans from EG Music, in turn supported the finances of Messrs. Alder & Fenwick. The financial viability of the partners had been extremely prejudiced by the drop in the property market (impacting the partners’ Old Chelsea Property Co.) and large cash calls on them as Lloyd’s Names, members of the Marine 475 insurance syndicate. Some of the £4 million lent by the EG Music Group to Athol & Co. was drawn from my (unpaid) record royalties from EG Records (on which EG Management also deducted 25% for “managing” my affairs).

Mr. Alder covered the deficit in my financial affairs, caused through his non-payment of my income, by arranging borrowing on my behalf (as my business manager with power of attorney) at Coutts & Co, Sloane Square. In effect, Mr. Alder created a form of forced (and undisclosed) borrowing from myself to Messrs. Alder & Fenwick (via Athol & Co.) and on which forced borrowing I also paid the interest.

The success of the EG Music Group was based largely on their ownership of their managed artists’ phonographic and publishing copyrights. My own copyright assignments to EG were made on the basis (as explained to me at Sherborne House on February 22nd. 1976 by Mr. Alder himself) that the assignments were necessary for EG to:

1. protect my interests;

2. collect my royalties;

3. protect the copyrights around the world.

This advice, given to me by Mr. Alder, was regrettably inaccurate: a licence to EG would have had the same effect, and my copyright interests would have remained mine. The effect of the advice was to favour EG at my expense (and similarly for the other Crimsons).

These are examples of a manager’s conflict of interest being wilfully exploited to advantage his own position, to the detriment of a managed artist owed a professional duty of care, if not the personal duty of care instinctively recognised and accepted by a gentleman.

This is the quick story. The longer story is an interesting one waiting to be told, with documents waiting to be scanned and presented online; it will be a research archive for those wishing to discover the mechanics of the music business in the 1970s & 1980s, some of its characters and business practices of the period. It is also a microcosm of the period and the widespread collapse of trust in professional bodies and “the word of a gentleman”; the weakening of controlling authority in the networks of public school contacts; and the abdication of responsibility towards clients in many areas of business.

Meanwhile, in the contemporary world of media ownership, a bona fide question that might be raised is whether the personal character of those involved in ownership of public broadcasting should be above reproach. This is perhaps one of several further enquiries that might be directed to the appropriate parties.

[NB Insert 5march2025: An overview of Mr. Alder’s professional career 1966-2009 from Debrett’s]…

VII

Remembrance Sunday 8th. November, 2009.

https://www.dgmlive.com/diaries/Robert%20Fripp/2009-11-08-rf-diary

11.31 In this Weekend FT’s Andrew Hill (Lombard) column…

We all suffer when banks abuse customers’ trust.

http://www.ft.com/cms/s/0/c299ab9c-cb0f-11de-97e0-00144feabdc0.html?nclick_check=1

Lombard: when banks abuse customers’ trust

By Andrew Hill

Published: November 6 2009 20:41 | Last updated: November 6 2009 20:41

The credit crunch and ensuing financial crisis were inflamed by a breakdown of trust on a grand scale.

The Financial Services Authority fined UBS £8m for its failure to prevent employees carrying out unauthorised trades with customers’ money. Four as yet unnamed members of staff foisted more than $42.4m of losses (since reimbursed) on to unsuspecting customers until someone blew the whistle.

Two insights stand out starkly from the FSA’s final notice of the fine. The first is the long period over which these abuses took place: two years, during which at one point up to 50 unauthorised trades were being made daily. That this happened during the “golden years” for banks, in 2006 and 2007, is no coincidence. The FSA suggests one material factor leading to the failures – the second important insight – was the go-go, bonus-fuelled growth UBS’s international wealth management business was pursuing at the time. As the Swiss bank’s own painful postmortem of its ill-fated expansion into subprime securities revealed, aggressive growth…

I have commented before that the abuse of trust, revealed very publicly in the collapse of the banking and financial sector during the past 12-16 months, is pretty much a commonplace of my life as a professional player over the past 42 years. Now ordinary, innocent members of the public may have a sense of life in the music industry.

Andrew Hill’s comments…

1. Unintentionally implied? For employees to have re-directed clients’ money is worse than for the principals to have done so?!!

2. The financial mess was inflamed by a breakdown of trust on a grand scale.

3. Two years is a long period for abuses to take place.

4. The go-go, bonus-fuelled growth UBS’s international wealth management business was pursuing at the time.

5. Ill-fated expansion into subprime securities...

If we recall the collapse of EG during 1988-1991:

1. The abuse of trust was by the principals of the EG Group, Messrs. Alder & Fenwick; albeit the employees mostly did what they were told, including those nominally holding responsibility for my own interests.

2. Mr. Alder was a chartered accountant, Secretary and Treasurer of Nordoff-Robbins Music Therapy, adviser to the Palace. Surely this was a man you could trust? A Good Guy That You Can Trust (to quote Mr. Alder himself) in an industry renowned for its, well, abuse of trust.

3. Two years is the period during which my record royalties were not paid, but redirected to the principals via Athol & Co, formerly EG Management, to support their collapsing affairs; ie the unpaid royalties were converted into forced and undeclared interest-free loans to the partners, while I paid interest on my own borrowing, arranged for me by Mr. Alder to cover the subsequent shortfall in my affairs.

4. Mr. Alder’s attention increasingly moved from the music and record industry, a money-making machine 1968-1978, into property and security interests after 1978; funded by advances for publishing & records on the EG catalogue (which were not shared with artists). EG was awash with money (c. 1977 to quote a former Power Possessor at Island Records). Contributions to the partners’ pension fund in the early 1980s was at £100,000 per annum.

5. The ill-fated expansion of Messrs. Alder & Fenwick was into the Lloyd’s insurance market, notably the Marine 475 syndicate.

Manuel Castells p3…

… power is based on the control of communication and information…

Control was the prime distinguishing feature of EG managerial policy. As one EG employee, with responsibility for KC, put it to me during Endless Grief: the first thing they taught us was, control the artist.

EG controlled information, and they also controlled the money supply of their managed artists. The Chieftains were one of the very few artists having a client account at EG (they were sub-managed within the office). I was a long-term artist, whose relationship had begun when one trusted the word of a gentleman. Mr. Alder even played this card, after I wrote to Coutts & Co. at Sloane Square (March / April 1991) to withdraw Mr. Alder’s authority to act on my behalf; eg to extend my own borrowing to cover his non-payment of due royalties). Mr. Alder declared to me: You made me look like a common criminal!

On the Nordoff-Robbins site, Monday, April 23rd, 2007…

Sam Alder retires as Chairman of Nordoff-Robbins Music Therapy

Sam Alder, Chairman and founding member of the Nordoff-Robbins Music Therapy Charity, has resigned from his position as Chairman of the Board of Governors at the advice of his doctors.

An accountant by trade, Sam spent much of his life in the music industry, managing bands including T Rex and Roxy Music. This work introduced him to the pioneering work of Nordoff-Robbins Music therapists and he became instrumental in establishing the charity, working firstly as Secretary, then Treasurer and latterly Chairman.

Pauline Etkin, Managing Director of Nordoff-Robbins Music Therapy, said: “Sam Alder’s contribution over more than 30 years to Nordoff-Robbins Music Therapy has been invaluable and wide. He has been a driving force in many aspects of the charity’s development and it is with great sadness that we see him depart. We all want to thank him for his support and wish him a happy retirement.”

In his various roles within the charity, Sam Alder helped to raise over £6m pounds, which allowed the building of a dedicated Music Therapy Centre, and the expanding of the range of the charity throughout the United Kingdom and overseas. This includes the establishment of therapy centres in Scotland and New York. He also initiated the establishment of the International Trust for Nordoff-Robbins Music Therapy, which has enabled the protection of the intellectual properties of the work…

(my emphasis).

Would that Mr. Alder had taken a corresponding interest in protecting the intellectual properties of his artists; rather than, for example, telling me that it was necessary to assign EG my copyrights so that they could collect my royalties, protect my interests and defend the copyrights around the world (Sherborne House on 22 February 1976).

On January 13th. 2009, our attention of DGM HQ was directed towards the 40th. Anniversary of the birth of King Crimson in the basement of the Fulham Palace Café. On that day, another event took place in London: City University awarded Mr. Alder an honorary Doctor of Arts for services to philanthropy and music…

Mr Samuel Alder is Senior Partner of Alder Dodsworth & Co, Chartered Accountants and runs the family estate which includes a dairy farm. After graduating from the University of Durham, Mr Alder qualified as a Chartered Accountant and started his career at Whinney Murray, now Ernst & Young. He ran the E.G. Group of music companies in partnership for twenty five years and was a founder investor of several commercial radio stations as well as the music industry’s main international charity Nordoff Robbins Music Therapy. For a number of years Mr Alder was the charity’s Hon. Treasurer and Chairman, as well as a Trustee of the BRIT Trust, and the Hon. Treasurer and later Vice Chairman of the Duke of Edinburgh’s Award Special Projects Group. He holds the positions of Chairman of the Isle of Man Creamery, Chairman of the Isle of Man Arts Council, Chairman of the Board of Governors of King William’s College, Chairman of the Association of Governing Bodies of Independent Schools and is a member of the board of the Independent Schools Council and also of the Independent Schools Inspectorate.

The Nordoff-Robbins site has this…

Sam Alder, a founding member of the original 1976 Nordoff-Robbins Fundraising Committee who served as Chairman of the Board of Governors from 1997 to 2007, was awarded an honorary Doctor of Arts by City University London at a ceremony on 13 January 2009. The honour was made for services to philanthropy and music, and in particular for his proactive work for Nordoff-Robbins Music Therapy over three decades. Pauline Etkin, CEO of Nordoff-Robbins Music Therapy, who nominated Sam Alder for the degree said:

"Sam Alder possesses a rare combination of talents. With a background in classical music, he qualified in the City as a Chartered Accountant with a major firm and then went on to become a principal in a music management and publishing company where he managed the careers of musicians such as T Rex, King Crimson, Toyah Willcox and Roxy Music. This combination of skills and gifts made him an ideal Treasurer in 1976 for the newly-formed Nordoff-Robbins Music Therapy Charity Fundraising Committee. This company of exuberant young people worked to raise funds within the music industry for a pioneering new way of using music to help children and adults with many forms of disability or illness, helping them to communicate and achieve an improved quality of life.

"In no small measure the amazing success of the charity over the years has been thanks to Sam’s many gifts. Under his wise guidance the charity grew steadily from year to year, to become the nationally operative organisation that it is today with an annual turnover of nearly £3 million, providing music therapy services across the UK, as well as two Master’s degree training programmes and a PhD programme, all validated by City University. In 1990 Sam was instrumental in raising six million pounds, which allowed the building of a dedicated Music Therapy Centre, and the expansion of music therapy throughout the United Kingdom and overseas. This included the establishment of therapy centres in Scotland and New York. He also initiated the establishment of the International Trust for Nordoff-Robbins Music Therapy, which has enabled the protection of the intellectual properties of the work.

"Sam is a remarkable man who combines many abilities which he has used freely for the good of all."

It would be interesting to ask artists formerly managed by Mr. Alder, notably Bryan Ferry and Toyah, in addition to their professional advisers, for comments on Mr. Alder’s many abilities which he has used freely for the good of all. Regrettably, Bryan and Toyah and others are restrained from commenting favourably on their relationships with Mr. Alder because they are bound by EG gagging clauses. As is most likely apparent to any reader of the Diary, I am not. This permits me to provide bear witness to some of Mr. Alder’s many abilities which he has used.

Quoteable Quotes:

SG Alder Esq.: I’m an honest, God-fearing family man (handwritten letter 1991).

SG Alder Esq.: We’re sorry for what happened (letter 1991; Mr. Alder didn’t say what happened).

Bill Bruford: Who manages the manager?

(The Autobiography 2009).

Albert Low: Conflict & Creativity At Work (2008) p.121 ... because (the president) is the dynamic center of the company, the way that he carries out his function will also determine the ethos of the company... he will determine its fundamental and distinctive character, its value system – the spiritual, ethical, moral and legal context within which the field operates; and also the social system – the way that employees will interact with each other.

P149 As (Elliot) Jacques pointed out… we have an innate sense of fairness, and when that sense is violated we suffer… cognitive dissonance that can range all the way from the sense of unease to a sense of outrage.

P169… the prevailing ethos in the corporate world is that greed is good.

Pauline Etkin, CEO of Nordoff-Robbins Music Therapy (2009): Sam is a remarkable man who combines many abilities which he has used freely for the good of all.

Guitar Craft Aphorism: There is merit, and blessing, and reward for those who undertake necessary work; attenuated to the degree that this work is undertaken in the anticipation of merit, and blessing, and reward.

I have seen in the industry, in various characters at various times, a trajectory from ambition to greed to exploitation to arrogance to hubris to collapse. But, it doesn’t matter much where we begin; it matters very much who we become.

VIII

Wednesday 27th. June, 2012

10.33 Ferdinand Mount asks why inequality has increased and indicates, as a prime feature, the centralization of power… Oligarchs flourish under the rule of law and within the framework of a democracy.

This is accurate in the affairs of EG, as directed increasingly by SG Alder Esq., where the power moved increasingly from the hands of the artists to that of EG Management. Conflict of interest ruthlessly driven, undue influence, and lying where necessary (while care was taken not to be caught and exposed in a lie) were characteristics of Mr. Sam Alder’s EG.

In EG I see a microcosm of the business world as it has developed over the past 36 years. I date the transition point, from market economy to market society: 22nd. February, 1976.

11.57 So, what is one effect of these Diary entries?

I

II…

III…

IV…

These are one clear indication of another change in the larger society: the availability of information. Control at EG included the control of information, hence gagging clauses on most former artists and employees. Had I myself signed the gagging clause included in the Settlement Agreement with EG, none of the above would exist.

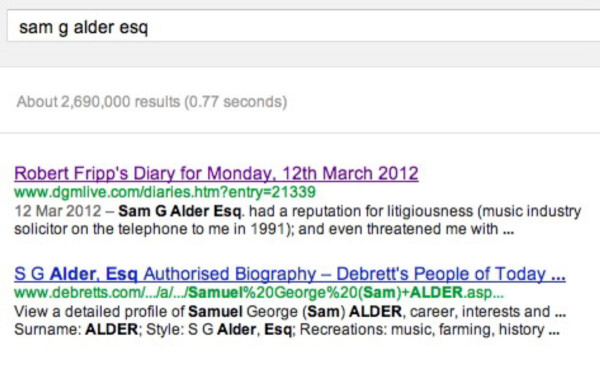

Dr. Sam G Alder now pops up on Google searches…

I

II…

III

King William’s College Society website

KING WILLIAM’S COLLEGE SOCIETY

President:

Dr Sam G Alder (J, S 1954-63)

Dr. Alder is himself on the square and King William’s has its own lodge…

Mr. Alder was honoured on January 1th. 2009, the fortieth anniversary of the birth of King Crimson…

Isle Of Man news website

Arts Council Chairman awarded Honorary Doctorate

Date Posted: 10/Mar/2009 00:00

By: David Le Prevost

The Executive Chairman of the Isle of Man Arts Council, Sam Alder, has recently been awarded an Honorary Doctorate of Arts for Philanthropy and Services to Music by City University, London.

Mr Alder was born and educated on the Isle of Man at King Williams College, where he is now Chairman of the Board of Governors. After qualifying as a Chartered Accountant and working in the City of London, his career took him into the music industry where he managed such acts as T-Rex, Emerson Lake and Palmer, Bryan Ferry and Roxy Music and Brian Eno. He is also a founder investor in several commercial radio stations, including 3FM on the Isle of Man. It was for his involvement with Nordoff-Robbins Music Therapy that Sam was awarded his Honorary Doctorate.

A national charity established in 1976, Nordoff-Robbins Music therapy has earned the respect and support of professional musicians from the popular and classical worlds, eminent physicians, psychologists, educationalist and many others. The charity is highly supported by the rock music industry and provides over 30,000 music therapy sessions at over 50 locations nationwide each year. The charity set up a Master of Music Therapy course for therapists, which is validated by City University.

He has played a central role in Nordoff-Robbins corporate development for over thirty years beginning as Treasurer and from 1997 to 2007 acting as Chairman of the Board of Governors.

Mr Alder was appointed to the Isle of Man Arts Council in 2002 and has been Executive Chairman since 2006.

Clearly, a man to be trusted and respected, an ideal character to play an important role in society and charitable institutions.

IX

Wednesday 5th. March, 2025

For those interested in the more recent developments of Mr. Alder’s financial undertakings, here is an overview from 2024…

https://www.three.fm/news/isle-of-man-news/former-music-impresario-given-restraint-order/

… of Mr. Alder’s ongoing litigation since 2012, the judgements of which may be found here…

From 2013…

https://www.manxradio.com/news/isle-of-man-news/island-businessman-sued-for-2-6-million/

Mr. Alder was found bankrupt in 2018…

https://www.dgmlive.com/news/Alder%20Bankrupt

… and his approach to the court cases arguably an abuse of process…